The Nigerian Communications Commission recently disclosed that multiple taxes may affect the growth of Nigeria’s economy if not properly checked.

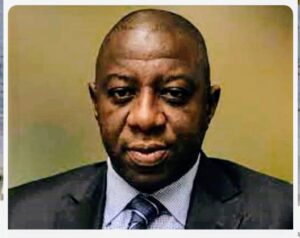

The NCC Executive Commissioner, Stakeholder Management, Adeleke Adewolu, dwell extensively on this during a regional stakeholders’ workshop held in Ibadan, Oyo State.

Adewolu spoke on the theme, ‘Navigating the Landscape of Multiple Taxation and Regulations: Fostering Sustainable Growth through Collaboration’.

He lamented that the presence of numerous taxes, often referred to as “nuisance taxes” by the World Bank, is impeding the country’s development.

Adewolu has this to say, “Despite the prospect of accelerated economic growth, the presence of multiple taxation which the World Bank has termed “nuisance taxes” has and continues to prove to be a bane on economic development in the country.

“The curious question, which this workshop will attempt to answer, is how a fiscal tool for economic development like taxation can become inimical to economic development. It is imperative, therefore, to correct some misconceptions about taxation, particularly the misguided notion of taxation as a penal tool for thriving business enterprises.

“It is thus evident that taxation is critical for making growth sustainable and equitable. Thus, taxation by design is an instrument for economic development, and it is important to acknowledge and support the initiative of all tiers of government in using taxation as an instrument for socio-economic development.

“It is pertinent to note that the National Tax Policy, 2017, emphasises the need to eradicate multiple taxations at all tiers of government. Specifically, the policy states that taxes similar to those being collected by a level of government should not be introduced by the same or another level of government.”

According to PUNCH, he assured stakeholders that the commission was committed to addressing the vexed issue of multiple taxations that hampers national growth, adding that the initiatives would create a conducive environment for both local and foreign investment.

Adewole said, the workshop is an avenue to rethink the country’s approach to taxation by adhering to its founding principles in respect to the overarching principles of taxation in a economy.

- Adewolu said, “The federal, state, and local governments would collaborate and harmonise tax policies to eliminate multiple taxations. President Bola Tinubu has shown commitment by signing Executive Orders aimed at curbing arbitrary taxes and establishing the Committee on Fiscal Policy and Tax Reforms. This committee will engage various stakeholders to identify concerns related to tax and fiscal policies, creating a more favourable environment for local and foreign investments.”

To cap it all however, the Executive Secretary, Association of Licensed Telephone Operators of Nigeria, Gbolahan Awonuga, urged governments at all levels to make the business environment more conducive for stakeholders.

PUNCH

More importantly, to stay updated with the latest news, health updates, happenings, and interesting stories, visit thescopermedia.com